Replica of Bloomberg Finance Lab at Dallas College Richland Campus.

Photo courtesy of Bloomberg

Contact: Malcolm Hornsby;

mhornsby@dcccd.edu

For immediate release — July 14, 2020

(DALLAS) — Gone are the days when financial competency was limited to balancing a checkbook. From analyzing price-to-earnings ratios to forecasting economic data, a new tool promises to propel Dallas College students into the ever-changing world of finance.

It’s called the Bloomberg Finance and Investment Lab, and judging by the large screens and intricate machines, you might assume this was just another trading room on Wall Street. But you would be wrong. This newly constructed setup is housed on Dallas College’s Richland Campus and aims to serve as a training ground for students looking to immerse themselves in the stock and trade of the business world.

“Simply put, there were not any community colleges around here that had a lab at all, and certainly not one like this,” said Roy Bond, Dallas College’s senior director of operations for workforce. “We really want to connect some of these career fields that pay a living wage to communities that historically haven’t had access to these types of jobs.”

What started as simply a goal to bring such a lab to the Dallas-Fort Worth metroplex in 2018 is now an unprecedented reality. Richland’s analytical powerhouse, now occupying the space of an old journalism lab, is equipped with 12 fully functional Bloomberg terminals and an interactive market wall featuring the latest on stocks, bonds and other investment data. But more importantly, it is the first and only lab of its kind at any community college in the state of Texas.

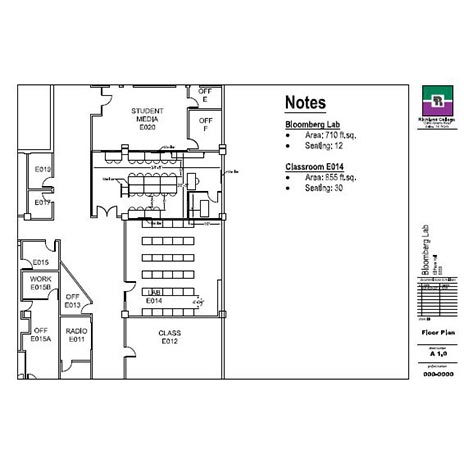

Richland Bloomberg Lab architectural plans

“It’s certainly a big deal, especially at the community college level. That’s why I jumped all over it,” said Todd Senick, the lab’s newly hired director of instructional support. “It’s getting those students to light up to the idea of pursuing finance as a career.”

In conjunction with Bloomberg and their educational group, Richland’s finance lab focuses on enriching the student experience through real-world learning scenarios using equipment found in financial markets across the globe. Led by Senick, much of the classroom curriculum is aimed at getting students certified on Bloomberg Market Concepts, which is made up of four modules: economics, currencies, fixed income and equities. It’s a knowledge and certification that will prove invaluable as students enter a job market eager for top talent. The DFW metroplex alone is home to several big-name financial firms and organizations, including JP Morgan Chase, Fidelity and Bank of America.

This large-scale operation comes at a price — about $1,900 per month, per terminal. Dallas College initially purchased three terminals, and a “buy one, get three” deal with Bloomberg ultimately resulted in an additional nine. Dallas College will pay for the first two years of operation, with the Richland Campus assuming financial responsibility thereafter.

According to Senick, it’s all money well spent.

“If you come out of community college knowing Bloomberg, you’re automatically at an advantage,” Senick said. “I think it’s a better tool for these students to move on to the next level.”

The lab is officially set to open this fall. And the statewide distinction is one the Richland Campus will not hold for long. Plans are in the works to construct similar Bloomberg Finance Labs at Dallas College’s North Lake Campus and Bill J. Priest Center.

# # #